Modern Invoice Matching: How AI Transforms a Critical Finance Workflow

Invoice matching doesn’t have to feel like a paperwork prison. Meet agentic AI automation, the smart, no-code way to free your finance team from the grind.

Have you ever seen a supplier invoice come through with the wrong amount, duplicate items, or linked to a purchase order that doesn’t exist?

If so, you’re not alone.

You’ve experienced the challenges of manual invoice matching.

Despite being one of the most fundamental tasks in the accounts payable process, manual invoice matching remains a time sink for finance teams. And in 2025, when businesses are chasing efficiency, cost control, and audit-readiness, relying on spreadsheets and eyeballs to catch invoice errors is like trying to run payroll on a typewriter.

The truth is: the stakes are high. Invoice fraud costs companies billions every year (Forbes, 2022). In one of the most notorious cases, a man posed as a supplier and tricked Google and Facebook into wiring over $100 million in fake invoice payments over a two-year period (BBC News, 2017). Both companies had the budget but lacked checks and balances.

This is where modern invoice matching makes a difference. Instead of relying on rigid, rule-based systems, today’s solutions use intelligent, no-code AI automation that adapts to real business needs and exceptions.

In this guide, we explain what invoice matching is, how it works, and how agentic AI platforms like Capably enable automated invoice matching in minutes rather than months.

What is Invoice Matching?

Invoice matching is the process the AP department uses for invoice verification, ensuring that a supplier’s invoice accurately reflects what was ordered and received before any payment process is initiated. It’s a critical checkpoint within the broader accounts payable and invoice processing workflow, acting as a safeguard against overpayments, fraud, and accounting errors.

Here’s how it typically works: when a supplier submits an invoice, the system (or person) compares key fields, such as product, quantity, unit price, and total amount, against the corresponding purchase order and, in some cases, a receiving report or goods receipt note. If everything lines up, the query receives invoice approval for payment. If not, it’s flagged for review.

Invoice matching is more than a helpful feature; it is a key control that helps your AP department maintain financial accuracy, compliance, and a clear audit trail. In industries that process many invoices each month, even small errors can lead to major losses or damage supplier relationships.

With rising transaction volumes and growing complexity in supply chains, invoice matching has become a major focus for automated invoice processing and AP automation. Manual methods just don’t scale.

The Types of Invoice Matching Explained

Not all invoice matching is created equal. The process varies depending on how many documents are being compared, how complex the procurement is, and the level of risk a company is willing to tolerate. Most businesses use one of three core methods: two-way matching, three-way matching, or four-way matching.

Each method offers more control and complexity. Here is a closer look at each one.

1. Two-Way Matching

Two-way matching compares the supplier invoice against the original purchase order. If the invoice lines, quantity, and price match the PO, the invoice moves forward for payment. This is a common choice for straightforward purchases, such as software subscriptions or office supplies, where goods receipts are not required.

Two-way matching is efficient but has some risks. It does not verify whether the items were received or inspected.

2. Three-Way Matching

Many finance teams consider three-way matching the best practice. In this process, the system compares the supplier’s invoice, the purchase order, and the delivery receipt (also called a receiving report). This extra step confirms that the goods were ordered and received in the right condition and quantity.

Most ERP systems and invoice matching software support three-way matching by default.

3. Four-Way Matching

Four-way matching adds one more checkpoint: a quality inspection report. This is typically used in industries such as manufacturing, pharmaceuticals, and aerospace, where compliance and product integrity are non-negotiable (Oracle, n.d.).

With four-way matching, the system checks four elements: the purchase order, the supplier invoice, the goods receipt, and the inspection outcome or packing slip. This method helps identify issues such as quantity or price deviations or damaged inventory, before payment is approved.

Moving from two-way to four-way matching helps businesses catch errors early and avoid invoice holds that can delay payments (Clear.Tech, n.d.).

Matching Type | Documents Compared | Use Case Example | Risk Level | Common in... |

|---|---|---|---|---|

2-Way Matching | Purchase Order + Supplier Invoice | Office supplies, recurring services | Medium | Small to mid-sized businesses |

3-Way Matching | Purchase Order + Supplier Invoice + Goods Receipt/Receiving Report | Physical goods, standard procurement | Low | Most finance departments; ERP use |

4-Way Matching | Purchase Order + Supplier Invoice + Goods Receipt + Inspection/Quality Check Report | Regulated products, manufacturing, pharma | Very Low | High-compliance industries |

Why Is Invoice Matching Performed?

Invoice matching is a financial control mechanism that protects cash flow, maintains accuracy, and safeguards supplier relationships. In accounts payable, it ensures that a supplier invoice reflects exactly what was ordered and received.

This reduces risks like overpayments, duplicate charges, and paying for goods or services that were not delivered. Matching also helps keep financial records accurate, making the reconciliation process easier and supporting better budgeting, forecasting, and vendor relationships.

A vivid UK case illustrates how failing to enforce matching controls can lead to substantial loss. In one instance, NEX Group, a major inter-broker dealer, paid out nearly £365,000 (around US $450,000) through 29 fake invoices submitted by an outside fraudster and approved by a complicit employee (The Standard, 2023). The invoices were crafted to look authentic, complete with forged emails and fake signatures. The City of London Police confirmed that the invoices passed AP review despite missing verification processes (City of London Police, 2023). This scheme only came to light during an audit years later.

Invoice matching also supports compliance. In regulated industries such as healthcare, logistics, or manufacturing, inaccurate invoice processing might trigger audits or legal exposure. It helps prevent invoice hold scenarios that delay processing and obscure visibility.

Timing is important, so real-time visibility into invoices and approvals is essential. Paying too early can tie up working capital, while paying too late can lead to penalties and issues with suppliers. A structured matching process helps keep payments on schedule and improves cash flow management.

As businesses grow and handle more transactions, strong invoice automation software helps maintain accuracy and efficiency. Automated invoice matching becomes essential, not just helpful.

How Is Invoice Matching Typically Done?

Manual invoice matching has traditionally involved comparing documents like emails, PDFs, spreadsheets, and procurement records side by side. An accounts payable clerk might match a supplier’s invoice to the purchase order, then confirm delivery with the receiving department using a delivery receipt, often switching between screens or printing documents to find mismatches.

This process becomes particularly complex when dealing with high-volume invoice submissions, multi-line invoice data, or discrepancies such as price deviations or missing goods receipt notes. If the documents don’t align, the document is flagged for invoice discrepancies and placed on invoice hold, stalling payment until a human resolves the issue.

Modern invoice matching software uses automated workflows to handle key steps like invoice capture, automatic invoice data entry, and rule-based comparison. However, most of these tools rely on robotic process automation (RPA), a rigid, rules-based approach that often fails when documents are incomplete, formats change, or suppliers send unexpected line items.

This is where a more flexible approach is needed. AI-driven tools with features like optical character recognition, pattern recognition, and intelligent document processing help companies move beyond fixed rules. These tools can understand context, spot detailed errors like cost or quantity differences, and adapt over time without constant IT updates.

In essence, invoice matching has evolved from paper trails and spreadsheets to structured logic, and now toward agentic process automation that learns and scales with the business.

Manual vs. Automated Invoice Matching

It is clear that invoice matching is essential. The main question is whether your current process can keep up as your business grows. Manual methods may work for a small number of invoices, but they are prone to human error. As volume increases, inefficiency leads to delayed approvals, missed discounts, more staffing needs, and a higher risk of mistakes or invoice fraud.

Manual invoice oversight is reactive. When there is a mismatch, someone must stop their work to investigate, find missing data, or escalate the issue. This creates bottlenecks, reduces visibility, and keeps skilled team members busy with routine tasks.

Automated invoice matching software, especially platforms that use agentic AI, shifts the process from reactive to proactive. These systems don’t just flag exceptions; they provide automated exception handling and understand them in context. They can adapt to changing invoice formats, resolve common discrepancies such as quantity deviations, and route complex cases for review without human intervention.

Here’s a simplified comparison of impact:

Area | Manual Matching | AI-Powered Automation |

|---|---|---|

Speed | Hours per invoice | Minutes or less |

Staffing requirements | High | Scalable with minimal team growth |

Error handling | Reactive, manual follow-up | Proactive, exception-aware routing |

Flexibility | Low (rigid to format changes) | High (handles variable invoice lines and vendors) |

Audit readiness | Inconsistent | Structured, transparent, and always-on |

Cost efficiency | Lower over short term | Higher over time due to reduced operational overhead |

Modern AI workflow automation tools are designed to remove repetitive, rule-based tasks, allowing staff to focus on strategy and vendor relationships. Your team can spend more time on exceptions, vendor negotiations, and expense reports, instead of tracking down paperwork.

Why Now? The Case for AI-Powered Invoice Matching

There’s a reason invoice matching is back at the top of the CFO’s agenda. The pressure is coming from every direction: rising operating costs, distributed finance teams working remotely, and the demand for faster, data-backed decisions.

This change is not just about automating routine tasks with more rules. It is about giving finance teams intelligent systems that can work on their own. Modern agentic AI understands workflows, adapts to context, and manages changes without constant updates.

The main advantage of this new automation is its adaptability. Unlike robotic process automation, which relies on fixed rules and can fail when formats or processes change, agentic workflows learn from data and improve over time. They are built to handle real-world complexity.

Most importantly, these tools are accessible. Platforms like Capably let small and mid-sized enterprises use AI-powered invoice matching without any coding. What once took months of IT planning can now be done in minutes with a no-code interface and built-in intelligence.

The result? Faster turnarounds, error reduction, less manual intervention, and finance teams that can scale without sacrificing control.

How to Automate Invoice Matching with Capably AI in Minutes

With Capably, automating this process only takes a few clicks. Tasks that once took days of planning and testing can now be completed in minutes. There is no coding, no long onboarding, and no need to involve your IT team.

Capably is a no-code agentic AI platform designed to help SMEs automate a wide variety of workflows. It gives you two options:

- You can use the pre-built agentic workflow library, which includes a database of common company processes across departments like finance, HR, and operations.

- Or, if you prefer to create something custom, you can simply describe your workflow in plain language. Capably’s AI agent will guide you through the process using its Describe–Criticise–Automate method to shape a solution based on your input.

To perform a simple invoice matching automation workflow, follow these steps:

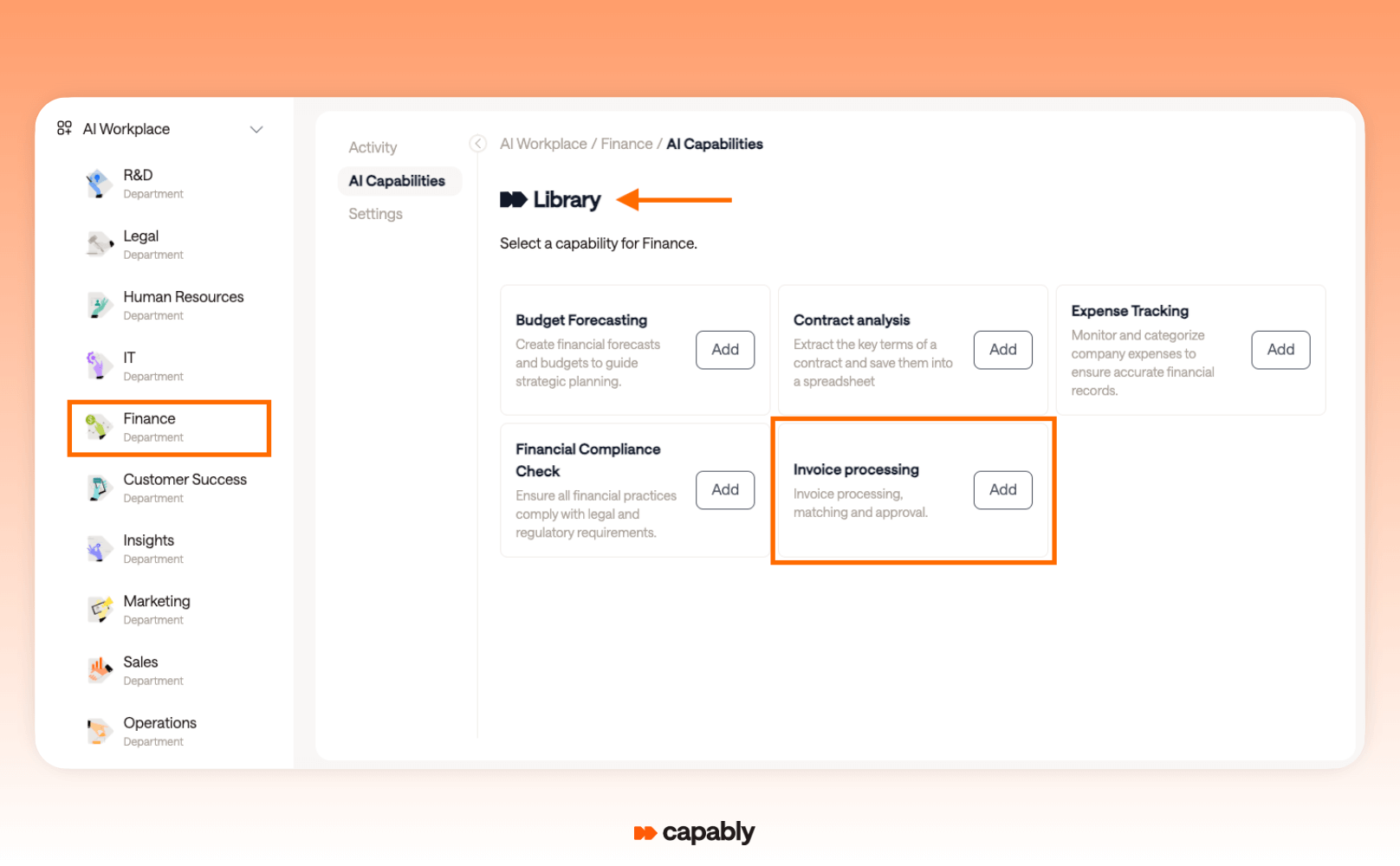

1—Open the Finance Department section in your Capably AI workspace. Click on the Library, find the Invoice Matching workflow, and click Add.

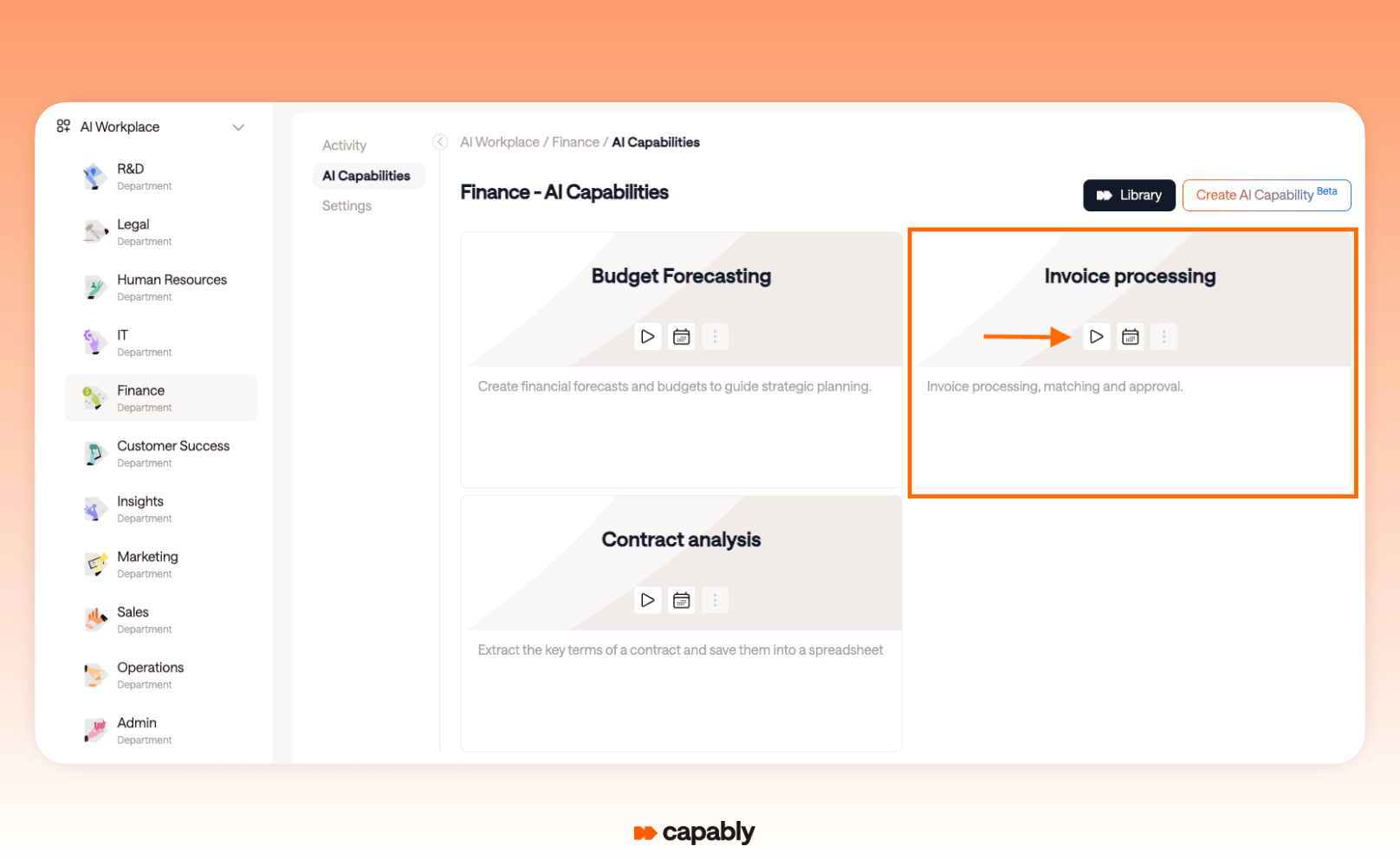

2—Back in your Finance workspace, click the Play icon to start the workflow.

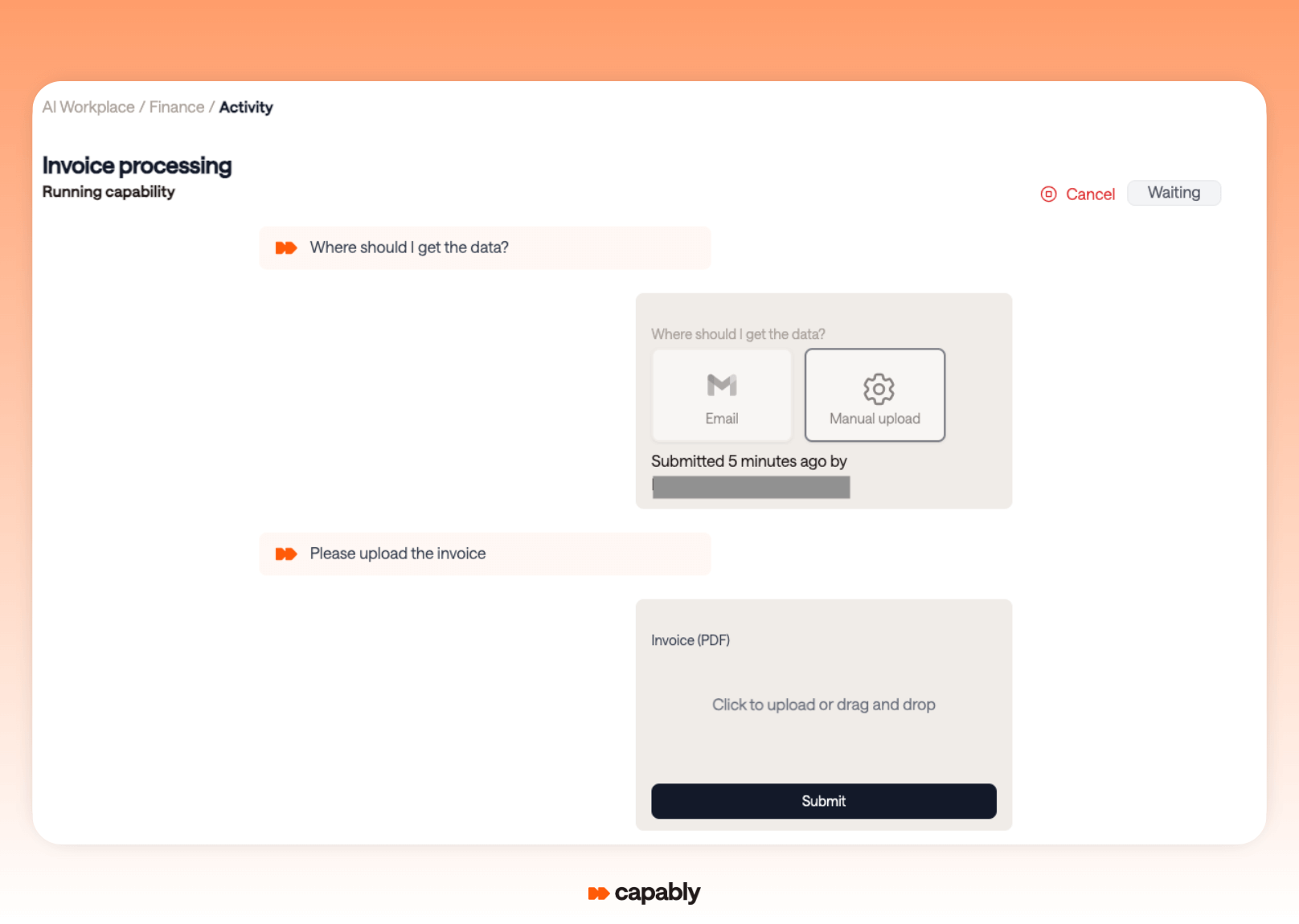

3—The AI agent will guide you. First, choose how to submit supplier invoices. In this example, we’ll use manual upload.

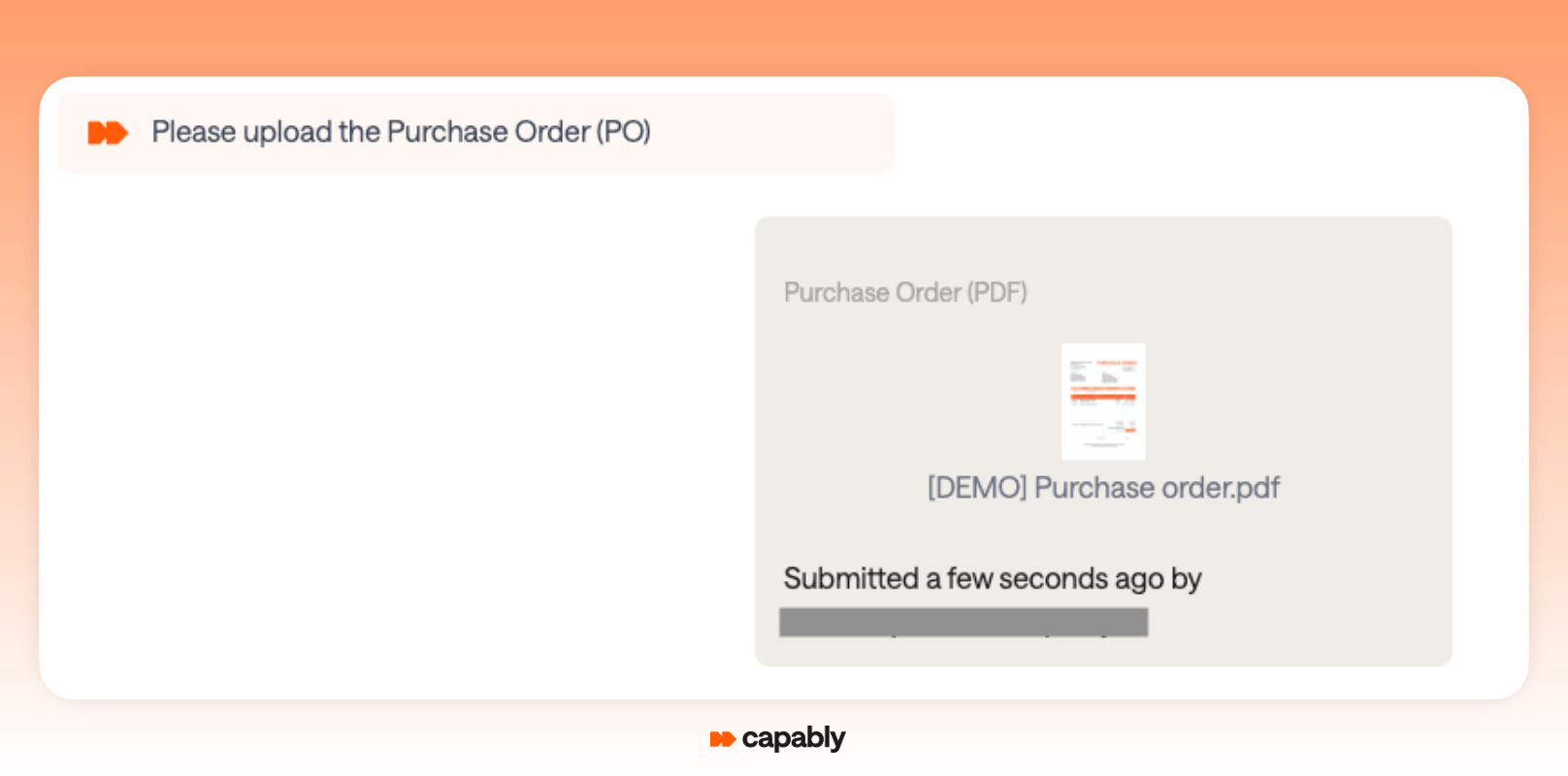

4—Next, upload the matching purchase order.

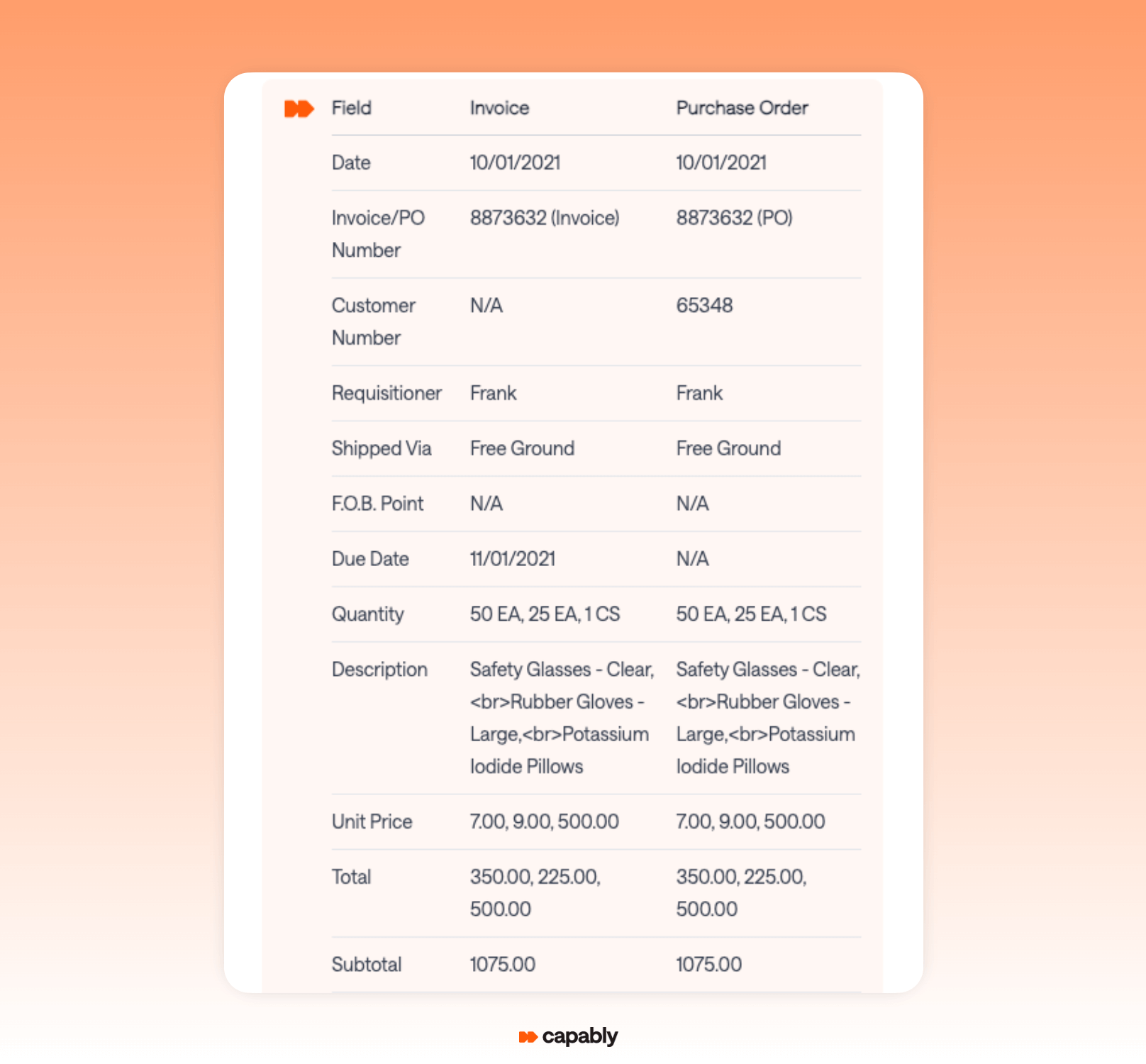

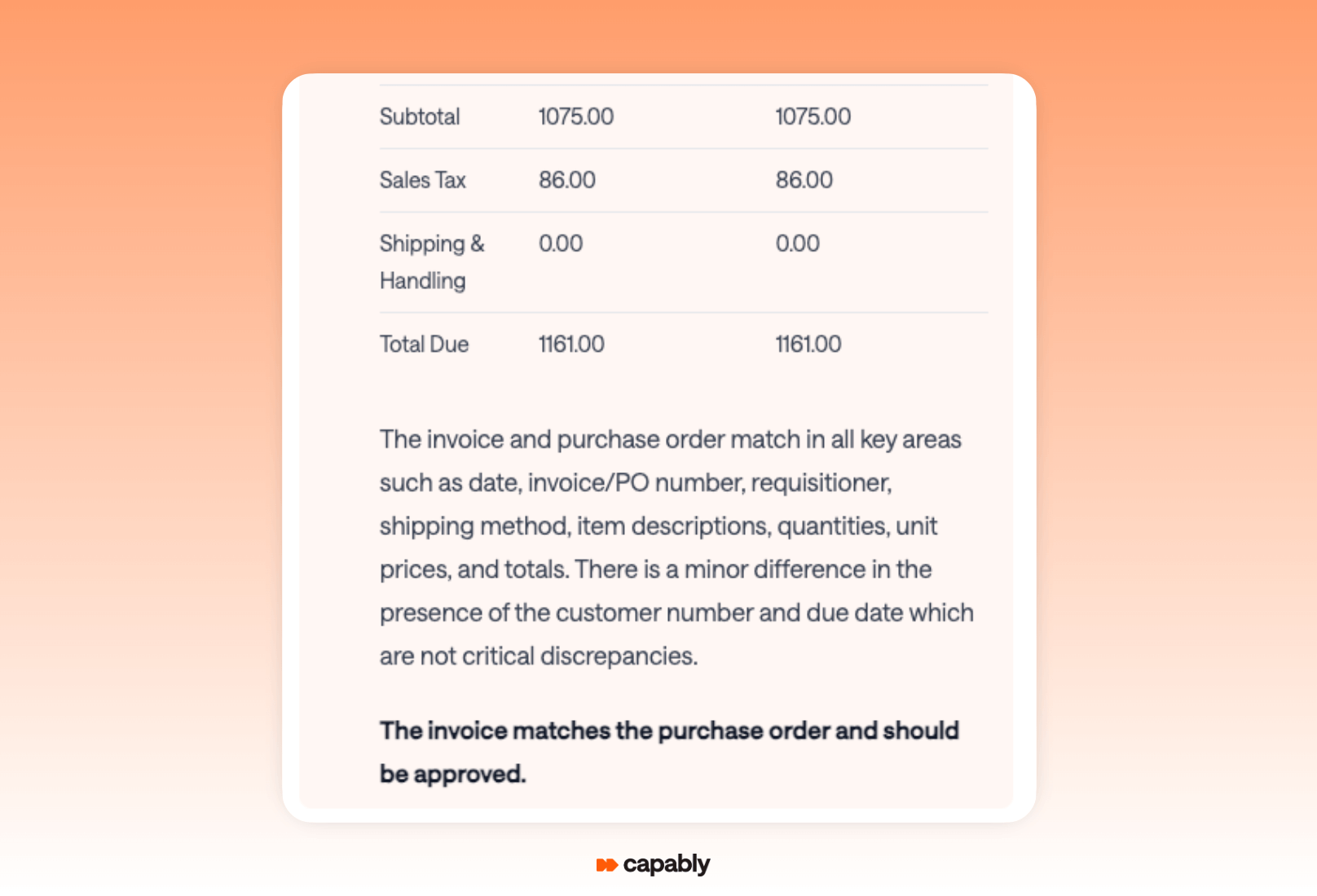

5—Capably’s AI will automatically analyze the documents.

6—The agent generates a matching recommendation based on the data.

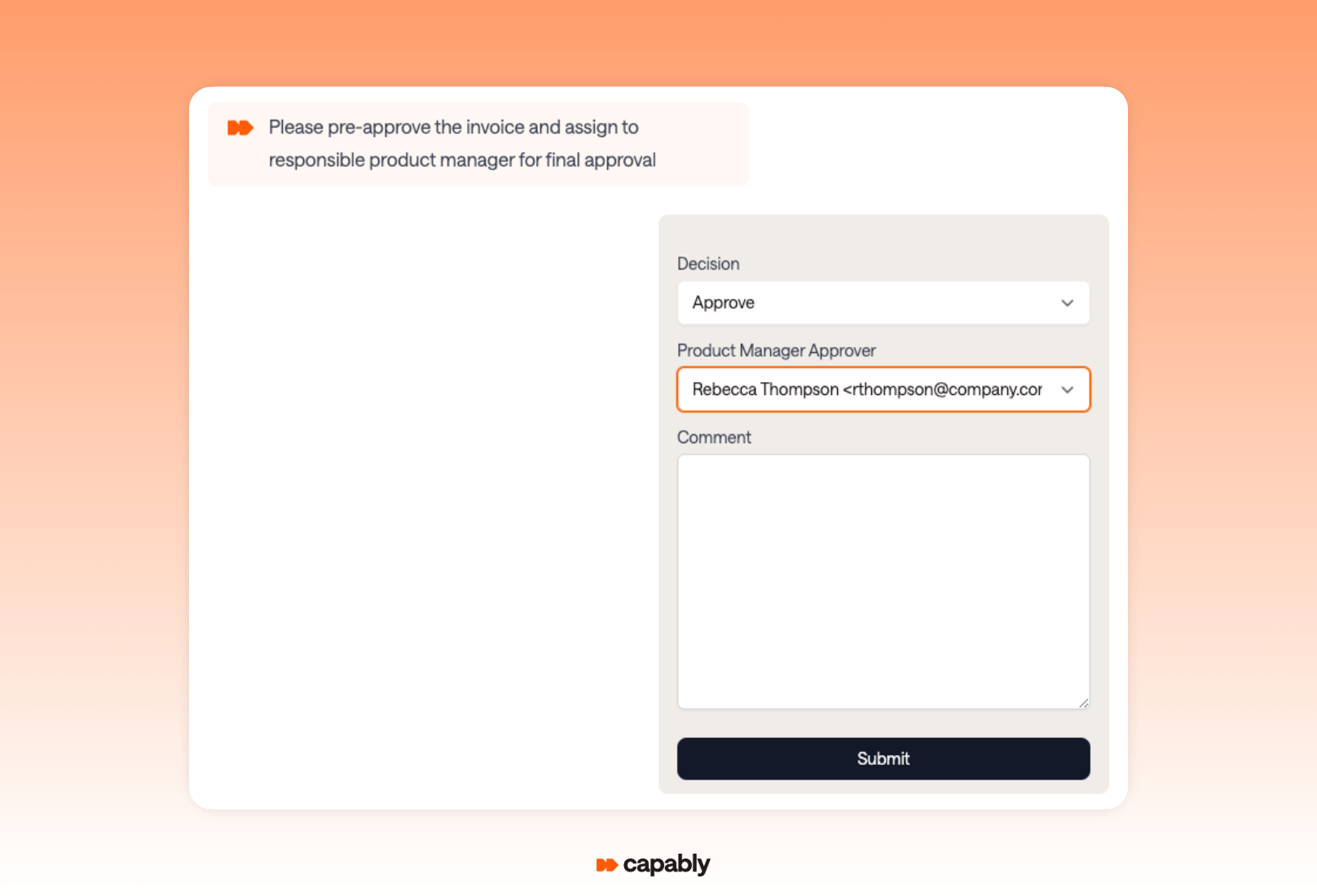

7—You can then route the results for review, add comments, and send for final approval.

Better yet, Capably can integrate directly with your enterprise resource planning (ERP) system. The automated system supports two-way matching, three-way matching, or four-way matching, depending on your business rules. Essentially, the system compares the invoice lines, purchase order, and relevant documents such as the receiving report. It automatically checks for price deviation, quantity deviation, and other inconsistencies. The results of the approval process are then shared with your approval chain or integrated directly into your ERP system.

What sets Capably apart is its adaptability. The system pulls data from emails, chat messages, or spreadsheets, and adjusts to your specific document formats and business rules, all without requiring custom code.

This is not traditional invoice matching software. It is a dynamic, agentic workflow that gets better with use and makes smart decisions, freeing your team from repetitive checks. Whether you process five invoices a week or five thousand, the system remains fast, accurate, and scalable.

Closing Thoughts: Smarter Finance Starts with Smarter Automation

Finance teams now have to do more with fewer resources, less time, and tighter controls. Meanwhile, the cost of mistakes and inefficiency has increased. This makes invoice matching automation a strategic step for running a smarter, more efficient finance operation.

The good news is you do not need a large IT budget to achieve this. Agentic AI platforms like Capably offer powerful, flexible, and accessible AP automation for finance teams of any size. Whether you manage a few invoices or are scaling up, these tools can match your needs.

Older automation focused on copying human actions with scripts and bots. The new generation of agentic workflow automation gives your team autonomous systems that understand context, handle exceptions, and get better over time.

If you have been waiting to modernize your invoice processing workflow, now is the time. This approach is practical, quick to set up, and has been shown to save time, reduce errors, and improve cash flow control.

In finance, every detail is important. Leading teams use AI to stay ahead, not by working harder, but by working smarter with automation.

FAQs

What kind of time and cost savings can we realistically expect from automating invoice matching?

Organizations that fully automate invoice processing cut cycle time from roughly 17 days to about 3 days, an 82% improvement (Bottomline, 2024). That speed can translate into meaningful savings in staffing costs, fewer late-payment fees, and faster month-end closes.

What happens if the AI makes a mistake or misses something?

Capably’s agentic workflows are designed to flag uncertain matches rather than force automation. You always have final review control before approval or ERP handoff. It’s a human-in-the-loop system, not a black box.

How does Capably learn or adapt over time?

Capably uses machine learning capabilities to get smarter with feedback. It improves how it classifies documents, detects mismatches, and routes approvals, especially in companies with complex or changing workflows.

Can Capably help us prevent invoice fraud?

Yes. Automated checks for duplicate invoice numbers, mismatched supplier information, or missing goods-received notes serve as real-time controls, supporting fraud detection. Fraudulent or suspicious entries are flagged instantly for review.

What if we outgrow the workflows we start with?

Capably is modular and scalable. You can start with invoice matching, then expand into adjacent areas like expense reports, purchase order matching, or vendor onboarding. All within the same platform.

Interested in seeing Capably in action? Contact us below to book a live demo and learn how agentic AI can streamline your finance operations in minutes.